The idea started in the fall of 2017, the start of my Junior year. I was taking my very first class in Probability and Statistics with a new mathematics professor, Dr. Vin Isaia. We hit it off and connected right away. I had recently left Rose-Hulman Institute of Technology the year before as did he. Since the Honors College had an advanced curriculum requirement, I decided to make this one of my upgraded Honors classes.

Dr. Isaia was the first person who showed me the beauty and power of computing. During class one day, he had mentioned the idea of a binomial process. Knowing I was of a finance background, he zeroed in on this idea and related it to how options are priced. We were able to go through the basics of options and most importantly the ways they are priced. Since Dr. Isaia was not a finance PhD, the jargon sometimes went over our head so I reached out to a close mentor of mine in the business college, Dr. Reza Houston. I owe a lot of the success of this thesis to these two individuals. Without them pushing me to learn and discover new ideas in their respective fields, I know I would not be where I am today.

After diving deeper into this topic through the rest of the fall 2017 semester, I knew options pricing would be a great topic for my honors thesis requirement for the Honors College. At this point, I was ahead of the game. Most students take the thesis class the fall of their senior year. This gave me an extra semester to jump start my programming and finance knowledge on options. The end result was a satisfying experience.

I was able to finish my thesis early and focus on my presentation of these complex ideas. I am highly satisfied with the deliverable I created which you can find below. It turns out I was not the only one who was satisfied with my work. The Honors College reached out to me and presented me with opportunities to discuss my research. By the end of my senior year, I was able to present on the topic on 5 separate occasions: - Verbal for ISU Foundation Board at Indiana State University on April 26, 2019 - Poster for Mideast Honors Association at Ball State University on April 5-7, 2019 - Poster for ISU Day at the Statehouse at Indiana State Capitol Building on March 11, 2019 - Verbal for Meeting of the Deans at Indiana State University on March 2019 - Poster for Honors Thesis Symposium at Indiana State University on December 6, 2018

It has been a rewarding experience to learn and understand a topic more fully outside of the classroom and then go on to present this research to people from a multitude of backgrounds. Indiana State University gave me several opportunities to refine my skills both on the analytical and personable spectrum. It has developed me into a better researcher and presenter. Statistics is built on these ideas of developing an abstract thought and then being able to go present it in a digestible way to people of all backgrounds. It will be fun to see where these skills take me in the future. Check out the full thesis below.

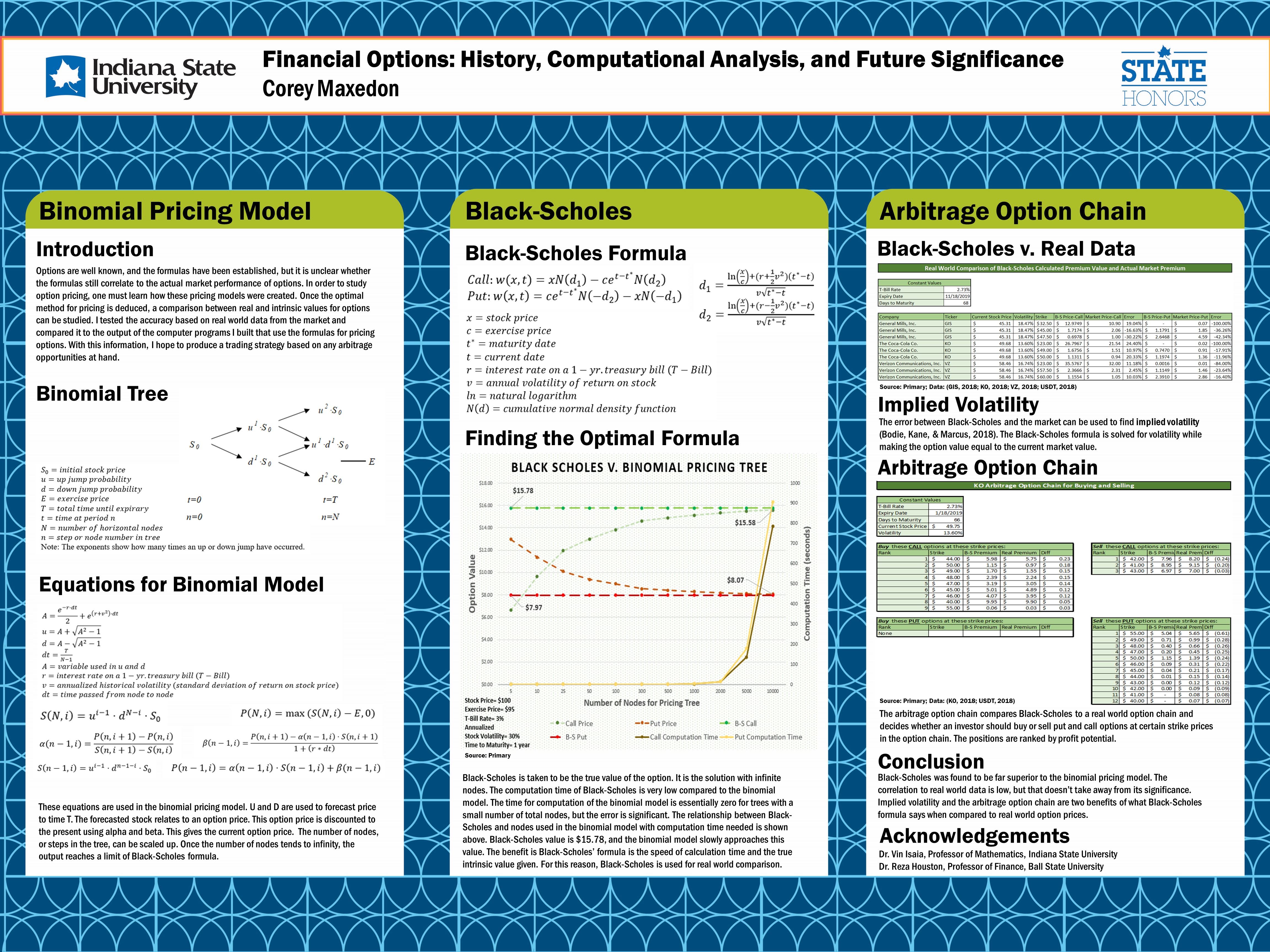

Abstract: This paper is directed toward a mathematical audience and looks at options, or derivatives, from a computational standpoint using computer programming with Python. A history of two options pricing formulas is given: the binomial pricing model and Black-Scholes’ formula (Cox, Ross, & Rubinstein, 1979; Black & Scholes, 1973). The two formulas are compared against one another to see the benefits of each. The Black-Scholes model is by far the superior way of pricing options. The binomial pricing model has a limit of Black-Scholes formula. The Black-Scholes model is tested against real world data, but significant error is found. The error can give an implied volatility for the stock, which indicates current stock volatility rather than historic. Black-Scholes can also use the error to find arbitrage opportunities in the market. I created a new options trading strategy using Python that gives a list of ranked arbitrage opportunities for all options in an option chain. The program lets the user know the optimal strike price to buy and sell put and call options in order to benefit on the arbitrage opportunities at hand. The future for options trading and pricing has not lost its significance since finding the solution 45 years ago.

Last Updated: 6/29/2020

Last Updated: 6/29/2020